Introduction

Bitcoin traders must understand market fundamentals. Technical indicators and candlestick patterns matter. This extensive article covers Bitcoin trading basics, including candlesticks and technical indicators for market monitoring and trading.

Learning Candlestick Patterns

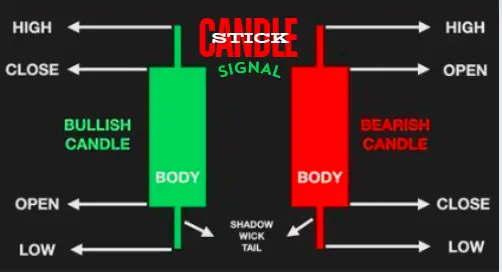

Candlestick charts are a popular and versatile technical analysis tool that depicts price variations over minutes, hours, days, or weeks. This graph illustrates opening, closing, high, and low prices over time.

Candlestick Chart Parts

1. Allotted time price activity is illustrated using a candlestick chart. Candlesticks have opening, closing, high, and low prices. These items complete the given chronological market picture.

2. The candlestick body displays the opening-to-closing price range. When the closing price is lower or greater than the starting price, it seems full or empty. A filled body is pessimistic, whereas an unfilled body is optimistic.

3. Wicks or shadows of top and bottom candlesticks. Wicks show period high and low pricing. Prices fluctuate and may reverse.

Analysis of Candlestick Patterns

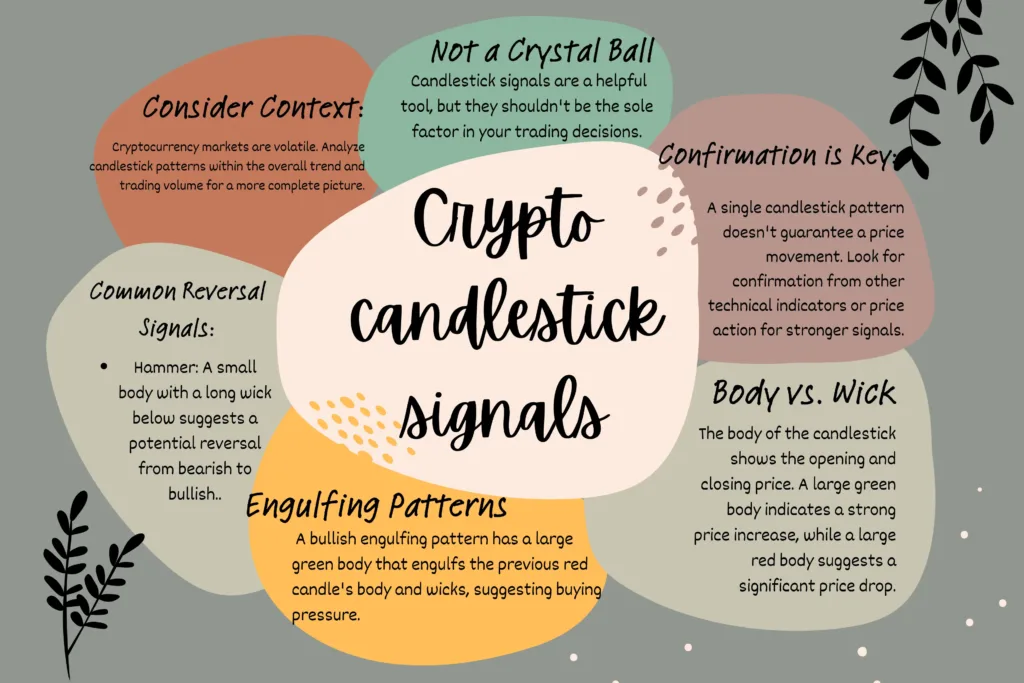

Candlestick charts help traders see market movements not just basic data. Traders can predict price fluctuations and alter strategy using these patterns Candlestick Analysis Ideas

1. Candlestick charts show market resistance and support. Purchaser desire prevents price drops, whereas opposition prevents price increases. Levels may help traders decide when to buy and sell.

2. Trend identification is needed for candlestick analysis. Candlesticks indicate bullish, bearish, or sideways markets. This allows traders to adapt to market changes, boosting odds.

Understanding Candlestick Style

Technical analysis famously uses engulfing candlesticks. It often predicts trend reversals, showing market emotion and direction.

Good Encapsulation

Bullish engulfing occurs when a huge bullish candle absorbs a bearish candle. When the bullish candle’s body overshadows the bearish candle’s range, attitudes improve. This trend predicts reversal and revival in the last stages of a recession. Buy for price gains with bullish engulfing formations.

Engulfing bearish pattern

A massive bearish candle completely engulfs a bullish candle. Bearish candles have larger bodies than bullish candles, signifying a negative attitude shift. Bearish engulfing patterns may suggest a downtrend near the conclusion of uptrends. A bearish engulfing pattern suggests shorting for a market downturn.

Interpreting Engulfing Patterns

Bullish and bearish engulfing affect traders. These patterns demonstrate market psychology and buying-selling pressure beyond aesthetics. Engulfing candles indicate more. Traders evaluate other technical indicators or price activity before trading engulfing patterns.

Hammer and Shooting Star Patterns

The hammer candlestick pattern may indicate financial market trend reversals for traders. A downturn usually entails a price decline and a rebound to around its previous price. A hammer candlestick has a short body and a long bottom wick. A hammer indicates a bullish move as buyers push the price up from its lows. Hammer patterns can indicate a reversal, draining selling pressure and signaling an upswing.

Shooting Star Pattern

Unlike the hammer pattern, the shooting star pattern appears at the apex of an upswing and may indicate a decline. The market rises strongly but closes near its opening price, forming a small body with a lengthy upper wick. The price dropped late in the session as sellers grabbed control with a shooting star. Shooting star patterns indicate trend reversals and drops for investors.

Knowing Hammer/Shooting Star Patterns

Hammer and shooting star candlesticks show market trends. The hammer pattern indicates a downtrend to uptrend reversal, whereas the shooting star pattern indicates a downtrend return. Trading these patterns generally involves price movement or other technical indicators. Market factors and timing affect these patterns.

1. During a downturn, Hammer Pattern buyers forced the price up at the opening level, creating a small body with a lengthy lower shadow. This pattern shows selling pressure is released and attitude improves. Trading long positions requires good market movement or technical signals.

2. Conversely, an uptrend peak shooting star pattern suggests purchasing pressure fatigue. Although momentum rose, sellers drove the price down to the starting level at the session’s end. This pattern warns traders of a bullish-to-bearish trend. Short sellers examine technical indications or price activity like the hammer pattern.

Hammer and shooting star patterns can foretell trend reversals, but skilled traders investigate other sources first. Technical indicators like trend-following oscillators or volume analysis may validate price behavior in the projected direction.

Hammer and Shooting Star relevance depends on the market and timing. Traders must analyze market movements, support and resistance levels, trading volume, and mood to understand these patterns. Longer trends are typically more reliable and significant.

Use Tech Indicators

Traders assess price swings and make judgments using many methods. Market trends are shown by technical indicators and candlestick patterns. These mathematical indicators assist traders evaluate market mood, trend direction, and trade entry and exit points using price and volume data.

Technical Index Types

1. Indices of trend

The Average Directional Index (ADX) helps traders and researchers analyze market trend strength amid turmoil. The origin is J. Wilder Jr. uses (+DI) and (-DI) indicators for directional movement. ADX values above 20 or 25 suggest trends, while below 20 indicates sideways markets. ADX helps traders see trends and manage risk. This indicator filters market noise to help traders estimate trend strength.

2. Oscillators

Technical indicators for traders include RSI and Stochastic. RSI detects market reversals by tracking recent price movements for overbought (above 70) or oversold (below 30) circumstances. To construct %K and %D lines, the Stochastic Oscillator compares closing prices to price ranges over time. %K above %D below 20 indicates oversold circumstances, advocating buying, while below %D over 80 indicates overbought conditions, selling. These indicators help traders spot trend reversals and switch strategies.

3. Volume-based Indicators

On-balance volume (OBV) tracks volume movement to predict price changes: rising OBV indicates accumulation, while lowering OBV indicates dispersal, implying price drops. The volume-price indicator shows buying or selling pressure for informed judgments.

Trade benchmark VWAP measures a security’s average price by volume. VWAP helps institutional and algorithmic traders evaluate transactions and reduce market impact. As support or resistance, it shows trading opportunities.

OBV and VWAP assist traders analyze markets. VWAP evaluates commerce, whereas OBV shows volume-price correlations. Indicators help traders recognize market changes and perform better.

4. Indices of volatility

Bollinger Bands show price volatility using a center moving average and higher and lower bands. Smaller bands are less volatile than bigger ones. Price changes may be indicated by band contractions or expansions. Contracting bands may signal volatility, while broadening bands may imply trend continuance or reversal.

ATR is another volatility indicator that tracks price change. Market volatility is calculated using the largest price difference range by ATR. Knowing price swings lets traders boost stop-loss orders during high volatility and minimize risk management during low volatility.

Technical Indicators Interpretation

Technical indicators, candlestick patterns, and support/resistance levels help traders strategize and decide. Using several indicators helps improve market understanding and trading, but no indicator is perfect. Traders must study each indicator’s benefits and downsides and adjust to the market.

Moving Averages

Moving averages smooth price data and show technical market trends and reversals. The most frequent moving averages are simple and exponential. Moving averages help traders spot crossovers and predict trends.

Simple Moving Average

A simple moving average estimates a security’s average price by adding closing prices and dividing by periods. Average security prices over 20 trading days are calculated by 20-day SMAs. A simple price history chart is SMA. Since all data points are weighted equally, it may lag price fluctuations.

Exponential EMA growth

The exponential moving average reacts faster to price fluctuations than SMA since it weights current price data more. EMA weights recent prices to establish a security’s average price. The EMA reacts faster to price movements, helping traders spot patterns. EMA indications may be unreliable in volatile markets due to price noise.

Moving Average Crossovers

Moving average crosses notify traders of trend shifts. Positive: 50-day EMA above 200-day EMA. This cross indicates a downtrend-to-uptrend shift, presenting purchasing opportunities. However, a bearish crossover happens when a shorter-term moving average goes below a longer-term one, signaling a decline and selling potential.

Moving Average Crossover Analysis

Moving average crosses can suggest trend reversals, but traders should evaluate other considerations before investing. Crossover signals should be tested against market context, including volume, support, and resistance. Transaction validation and risk management are essential in turbulent markets that may generate misleading signals.

Relative Strength Index (RSI)

Technical analysis momentum oscillator Relative Strength Index (RSI) helps traders understand financial market price fluctuations. The RSI identifies overbought and oversold circumstances to assist traders enter and exit trades.

How RSI Works

The RSI measures price movement strength over 14 periods and ranges from 0 to 100. Oscillators compare recent gains and losses to gauge buying and selling pressure.

Making RSI Interpretations

Many traders use RSI to judge market overbought or oversold:

Financial asset values are assessed by traders and investors using momentum oscillators like the RSI. Created by J. In Welles Wilder, the RSI evaluates price speed and change to signify overbought or oversold.

Traditional RSI interpretations are 70 and 30. An asset may be overbought at RSI 70. That shows purchasing pressure has raised prices unsustainably. Overbought situations may indicate a price correction to traders.

When the RSI surpasses 70, the asset’s price may revert after rising swiftly. Overbought situations signal a halting or fatigued rise. Traders may profit from overextended prices.

When the RSI is overbought, traders use several approaches. Some short or sell the asset expecting a drop. Others may boost stop-loss orders to safeguard upswing profits. The RSI may decrease from overbought before traders establish long positions, signaling a market attitude shift.

RSI can suggest market reversals, but additional indications must be considered before investing. RSI overbought levels should be considered with market dynamics, fundamental research, and other technical indicators to avoid misleading signals. In fast-moving markets, the RSI may give erroneous or premature indications, so traders should be cautious.

Relative Strength Index (RSI) helps traders and investors spot oversold or overbought financial assets. When the RSI slips below 30, assets may be oversold and plummet swiftly.

Understanding Oversold Circumstances Oversold circumstances indicate negative market sentiment, decreasing asset values. Traders expect a price reversal or recovery as selling pressure eases and purchasers exploit perceived undervaluation.

When the RSI drops below 30, the asset’s price may be unsustainable, delivering a strong risk-reward. Oversold situations may indicate a weakening downtrend, raising the possibility of a price flip.

When RSI is oversold, traders use several methods. Price recovery may require long holdings. Technical signs or price patterns may allow others to enter. Traders reduce risk with stop-loss orders.

RSI Trading Methods

Trading techniques use RSI to determine entry and exit. For instance:

RSI divergence and price movement may indicate trend reversals. When the price falls but the RSI rises, bullish divergence implies an upward reversal. Bearish divergence indicates a downtrend reversal at a higher price and lower RSI highs.

Crossovers: Traders can enter or exit at 70 and 30 RSI. A negative RSI below 70 signals a sell opportunity as overbought becomes neutral or oversold.

Moving average convergence divergence (MACD)

Technical analysis relies on the trend-following momentum indicator MACD. Showing the link between asset price moving averages helps traders see trends and buy/sell opportunities.

MACD parts

Three components make up MACD:

1. MACD Line: The asset’s short- and long-term EMAs fluctuate. A major trend indicator is price momentum.

2. Signal Line: MACD’s 9-day EMA triggers. It smooths the MACD line and helps traders discover trend reversals and entry/exit locations.

3. Difference MACD-Signal histogram. Positive MACD lines above Signal lines suggest bullish price momentum, while negative ones signal bearish.

Interpreting MACD Crossovers

MACD crossings are traders’ main buy/sell signals:

1. MACD above Signal is bullish. The crossover signals an upswing because short-term price momentum rises faster than long-term momentum. Traders may buy expecting a price rise.

2. MACD below signal is bearish. This crossing implies a slump as short-term price momentum slows relative to long-term momentum. Traders may sell anticipating the asset’s price to decrease.

Trade MACD strategies

Beyond crosses, MACD may be utilized for various trading strategies:

• MACD line divergence with price might identify trend reversals like other oscillators. When the price makes lower lows and the MACD line makes higher lows, bullish divergence suggests decreasing negative momentum and an uptrend reversal. Bearish divergence indicates a downtrend reversal when price and MACD line highs differ.

Conclusion

Technical indicators and candlestick patterns assist traders trade Bitcoin price variations. Trading volatile cryptocurrency markets requires several indicators and patterns since no signal or pattern is perfect. These concepts can help you trade Bitcoin with practice.

Comment