Profitable bitcoin trading requires reading and responding to market signals. Candlestick patterns can indicate market sentiment and price changes, among other trading tactics. The book details crypto candlestick patterns and trading strategies.

Candlestick Pattern Reactions

The global discipline of financial market technical analysis was formed by Japanese candlesticks. Candlesticks reveal price data beyond the opening, highest, lowest, and closing values.

1. Candlestick plotting for Japanese rice market research is nothing new. Infographics helped Japanese traders understand Medieval pricing changes. Watching prices showed a technical analysis of candlestick patterns.

2. Candlestick patterns began in Japanese financial markets but spread globally. Analysts and traders worldwide value visual data for market dynamics and price swing prediction. Everyone likes their asset class and market flexibility.

3. Analysts need candlestick charts. A minute, hour, day, or week of market price action is shown by one candlestick. The beginning, middle, and end of the candlestick price range may indicate market mood.

4. Candlestick starting and closing prices signify bullish or bearish. Positive traders suggest buying if the ending price is higher than the starting price. Candlesticks below the market’s open indicate heavy selling and bearishness.

5. New Market Trends: Prices fluctuate more dramatically for candlestick wicks than bodies. Intraday peaks and strong drops may suggest resistance by expanding shadows at each hour. Extended lower shadows on a price chart indicate support from the day’s lows and recoveries.

6. Pattern recognition is easier with candlestick analysis. Candlestick patterns include engulfing, Doji, hammers, and shooting stars. Each pattern symbolizes the market mood for traders. Trade may increase with stronger price forecasts.

7. Candlestick patterns work with other indicators and tools for technical analysts. Traders use candlestick analysis to detect price reversals. Combining it with various tactics helps all traders.

8. Candlestick pattern technical analysis works independently of trading instruments or market volatility. As markets get more complex, traders use visual tools to change strategy. Candlestick analysis helps traders understand price changes and make informed decisions under unforeseen market situations.

Exploring 16 Essential Crypto Candlestick Patterns

Bitcoin prices are volatile, therefore effective trading requires accurate signals. Candlestick patterns may indicate market buyers’ and sellers’ moods.

Bitcoin market analysis using 16 candlesticks.

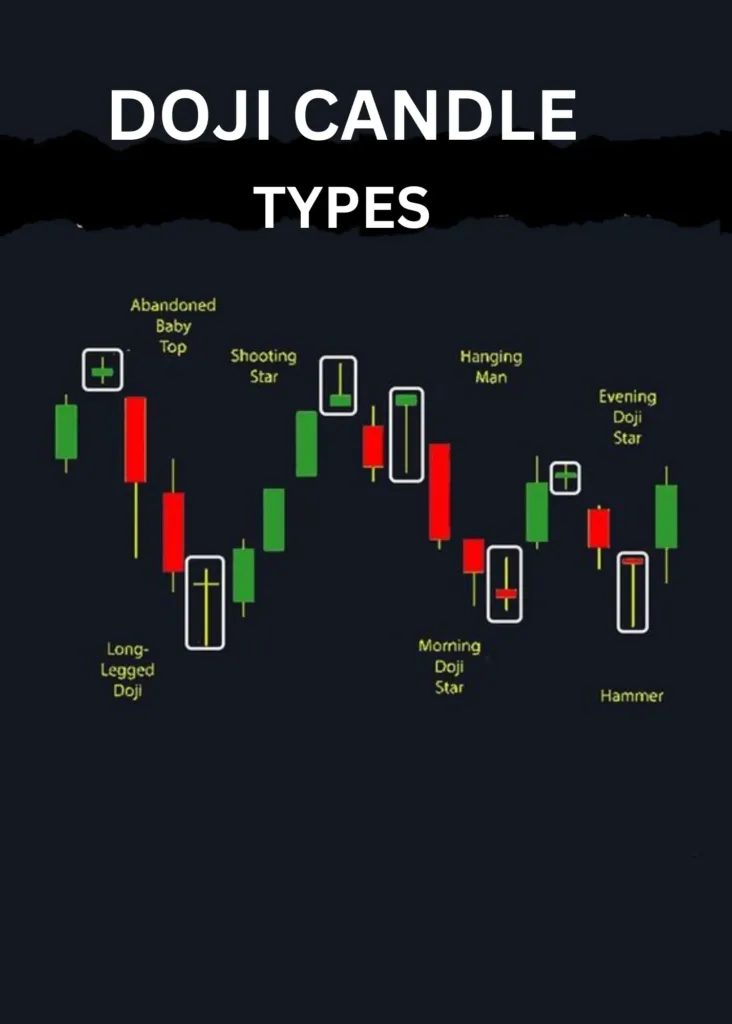

1. Doji

Tech identifies doji candlesticks. Market volatility and price chart reversals are common. Dojis have several meanings. Slim and expensive, doji candlesticks are easy to spot. Candlestick patterns with narrow bodies and long upper and lower shadows may suggest trading volatility.

Further research of the Doji pattern demonstrates the buyer-seller power balance. A Doji candlestick pattern suggests market turmoil and trend reversal following a large move. Balanced Doji candlesticks signal market neutrality. Stable pricing makes market movements hard to predict, unsettling traders. Market expertise is needed to understand Doji candlesticks. Doji at significant support or resistance levels matter more. A support Doji may signal a downtrend peak, while a resistance Doji may indicate an uptrend bottom.

Doji patterns can foretell trend continuance or reversal. Doji candlestick patterns may suggest a trend reversal following prolonged price movement. Chart patterns and technical indicators might help traders before trading. Stop-loss orders and small positions limit trading losses. They help during market crashes.

2. Hammer

Hammer candlesticks—bullish reversals—are fascinating. Small body, lengthy hammer-shaped underbelly shadow. This frequently enhances market confidence following a dip.

Appealing and Important:

Opening and closing prices are similar, and the top is weak. The Hammer symbol’s under-body bottom shadow represents session highs and lows. The most notable.

Hammer candlesticks may indicate sellers’ fatigue and buyers’ price-raising amid a long drop.

Sellers dominated early, but buyers took control by the session’s end due to decreased shadow indications.

3. Shooting Star

Shooting Star candlesticks—small body, lengthy top shadow—may suggest bearish reversal. Gains may depress the market. The Shooting Star is appealing and vital because of its low trading range, resulting in minimal price fluctuations between market opening and closure.

A shooting star’s greatest upper shadow symbolizes session charges.

After a long rise, consumers depart and sellers lower prices, making a shooting star candlestick.

Buyers drove prices higher early in the session, but sellers took control before the session concluded, adding to the sour mood depicted by the long upper shadow. On upswings, more shooting stars may indicate uninterested clients. It usually follows a spike. Shooting stars near trendlines or historical highs may indicate a market turn.

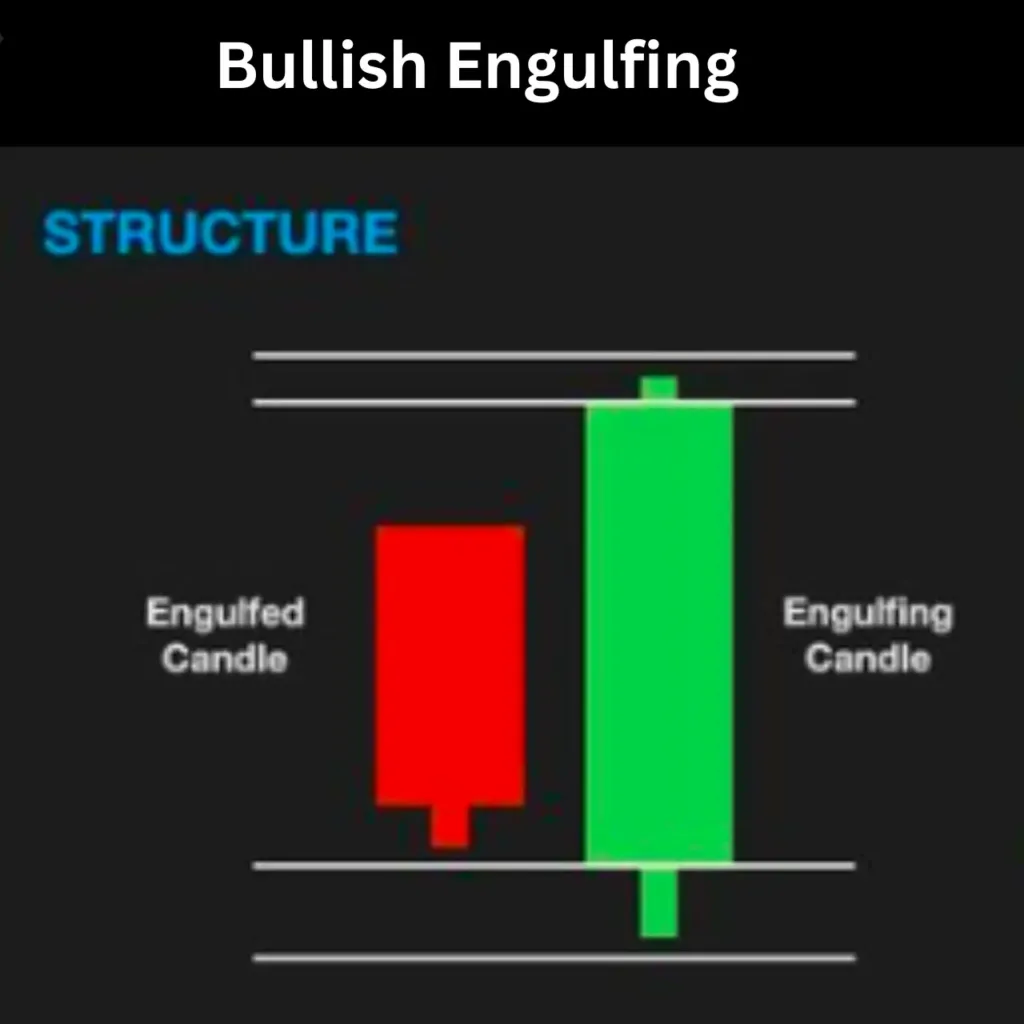

4. Bullish Engulfing

Confidence-Building: Bullish Engulfing on price charts indicates market optimism. Bullish candles around bearish candles indicate market volatility.

Notable traits: The Bullish Engulfing pattern involves a bullish candle completely engulfing a bearish candle. This substantial rise suggests optimism has beaten pessimism. When buyers overwhelm sellers, bullish engulfing patterns indicate market momentum. This move generally raises prices. Bullish and bearish candles determine bullish engulfing pattern strength. Consider larger bullish candles.

Criticism and Importance: A Bullish Engulfing pattern may indicate a shift in market mentality, suggesting less selling pressure and increased buying demand. After Bullish Engulfing, traders expect price confirmation. Bullish rallies or continuation patterns may support this. A bullish engulfing pattern after a long downturn may signal that sellers have exhausted their pressure and a positive reversal is approaching.

5. Bearish Engulfing

The Engulfing pattern is significant in downturn markets. Bearish candles swiftly replace bullish ones.

Bearish engulfing patterns are full reversals when bullish candles engulf bearish candles. Since sorrow has replaced optimism, this great activity signals a change. Bearish Engulfing patterns indicate market swings when selling demand exceeds buying intent. A large price decline frequently follows this reversal. Bearish engulfing patterns have larger candles like Bullish patterns. Large negative candles improve confidence and signal strength.

Criticism and Importance: Bearish Engulfing patterns signify market weakness and higher sales. A trader may search for a negative continuation pattern or price decline to confirm negative Engulfing.

Remember: Bearish engulfing patterns are more noticeable during oscillator bearish divergence, high resistance, and overbought conditions. Above-average trading volume boosts bearish engulfing and selling.

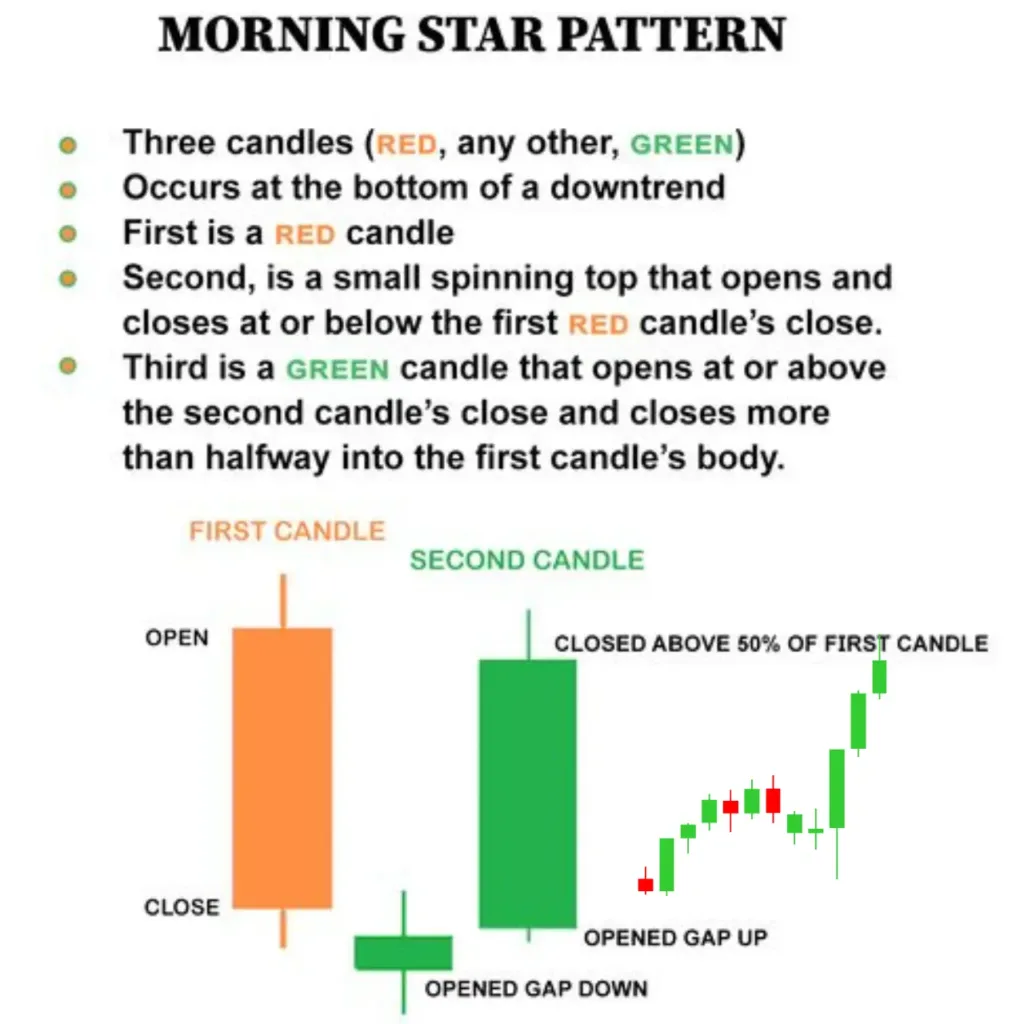

6. Morning Star

Morning Star’s bullish reversal requires three price chart candles. Depressed candlesticks indicate stagnation. A small fire, or “star,” indicates market uncertainty. When broken, a lengthy bullish candlestick may portend a bright future. Morning Star patterns at chart bottoms indicate price movements. A momentum increase pleases traders.

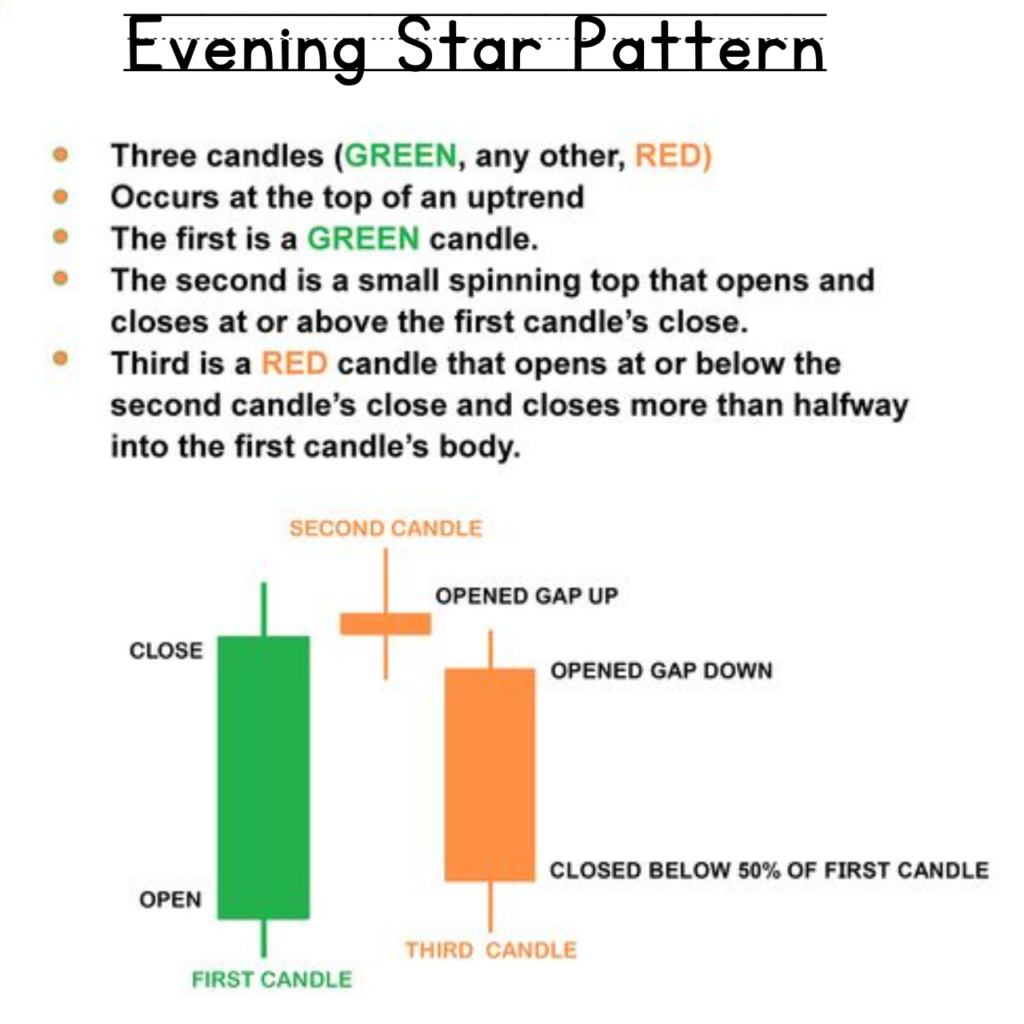

7. Evening Star

Evening Star, a three-candle bearish reversal pattern, appears on price charts. Long bullish candles occur amid strong upswings. The “star,” a little bullish or bearish candle, signals market uncertainty. Lengthy bearish candles show decreasing bullishness near the pattern finish. Evening Star patterns on price charts indicate price drops after gains. Trading techniques that allow negative momentum may succeed.

8. Hanging Man

The Hanging Man, like the Hammer candlestick pattern but more prominent on price charts, may form at an uptrend’s peak. A small size and long bottom shadow may indicate an upward slide. It indicates a major change but does not guarantee a market turn. A bearish reversal may be approaching as the lengthy lower shadow suggests buyers losing strength. The Hanging Man should warn traders of a market downturn.

9. Inverted Hammer

Hammer Pivots: Inverted Hammer and Hanging Man symbols appear on price charts upon downtrend bottoms. Great layout. A little top shadow and lower body may indicate an upturn. This pattern may reverse the downward trend by attracting buyers. After the powerful but brief Inverted Hammer, traders could expect favorable movements.

10. Bullish Harami

A Complete Guide to Bullish Harami Patterns

When a bullish candle is flanked by a bearish candle, a bullish Harami prices chart pattern is small but notable. If sellers relax, this trend may reverse. Although weaker, the Bullish Harami is bullish. Investors expect market sentiment to change. Find positive tendencies and act, they say.

11. Bearish Harami

Complete Study of Bearish Harami Formation

Bearish Harami is a common price chart pattern with a bearish candle inside many Bullish candles. If this trend reverses, sales may fall. Bearish Haramis tumble like bulls but have direction. Thus, traders interpret negative swings in coming sessions as a market mentality shift.

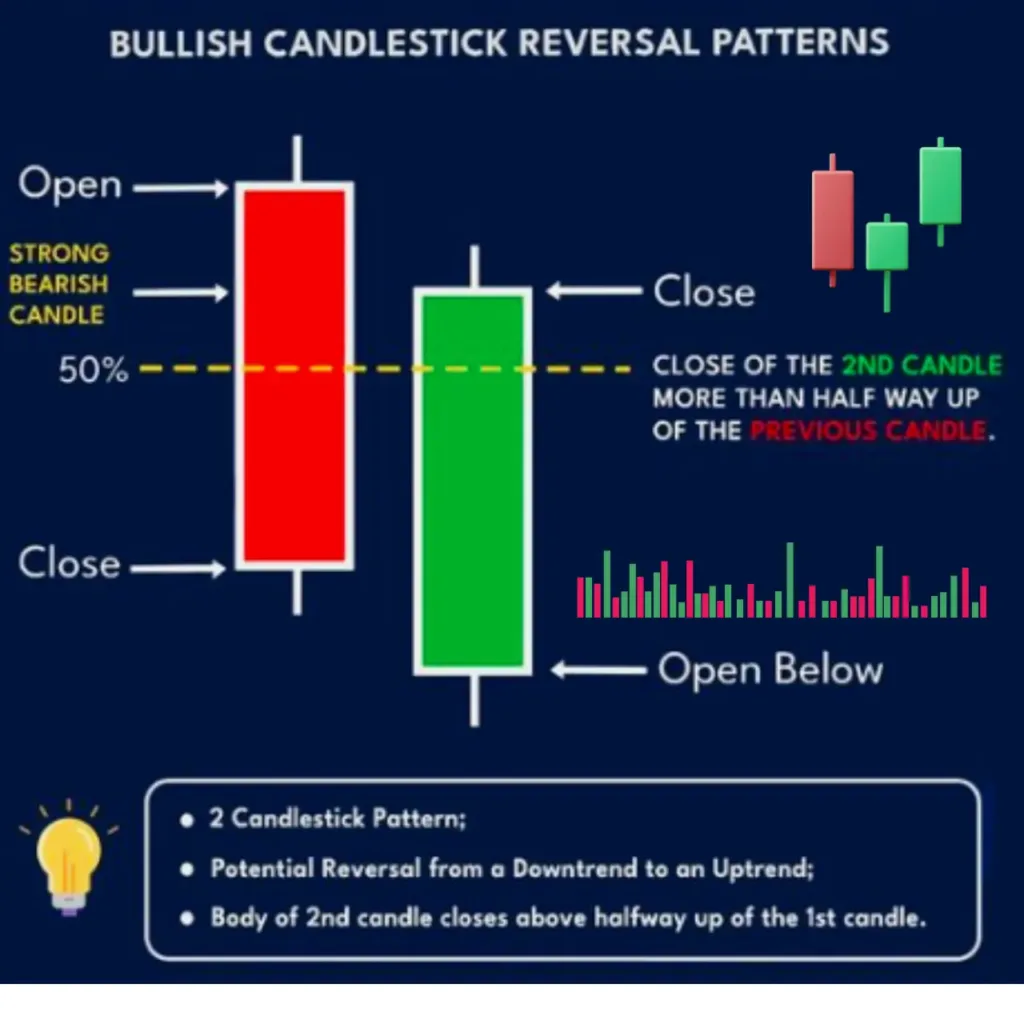

12. Piercing Line

Bullish candles cross midway through the previous bearish candle in Piercing Line patterns. Market sentiment has altered substantially. Buying pressures over selling pressures may indicate a resurgence. Starting below the previous candle’s low and ending above its middle is the greatest bullish indicator. Piercing Line patterns indicate bullish momentum, thus traders should expect larger gains in the coming weeks.

13. Dark Cloud Cover

If a negative candle closes below the midpoint of the preceding bullish candle, market sentiment shifts, unlike the Piercing Line pattern. Spectrum of black clouds. This pattern suggests a bearish reversal since selling pressure outweighs buying pressure. A reliable bearish candle has an upper shadow above the previous candle’s high and a lower shade below its middle. Trades may be sluggish under dark clouds. So they follow the market and plan for its decline.

14. Morning Doji Star

Morning Doji Star is a bullish reversal pattern with three candles. Doji candles signal market uncertainty, followed by extended bullish candles. Doji candles in patterns indicate trend shifts. The Doji candle’s downward gap from the bearish candle amplifies the signal. Fearing further developments, investors follow the Morning Doji Star pattern for bullish momentum.

15. Evening Doji Star

The Evening Doji Star is a three-candle negative reversal, unlike the bullish pattern. Doji candles, long bullish candles, and short bearish candles indicate market uncertainty. Falling doji candles accentuate the pattern’s reversal. Create an upward gap between the Doji and the previous bullish candle to confirm. When traders look for negative momentum, the Evening Doji Star may indicate a drop.

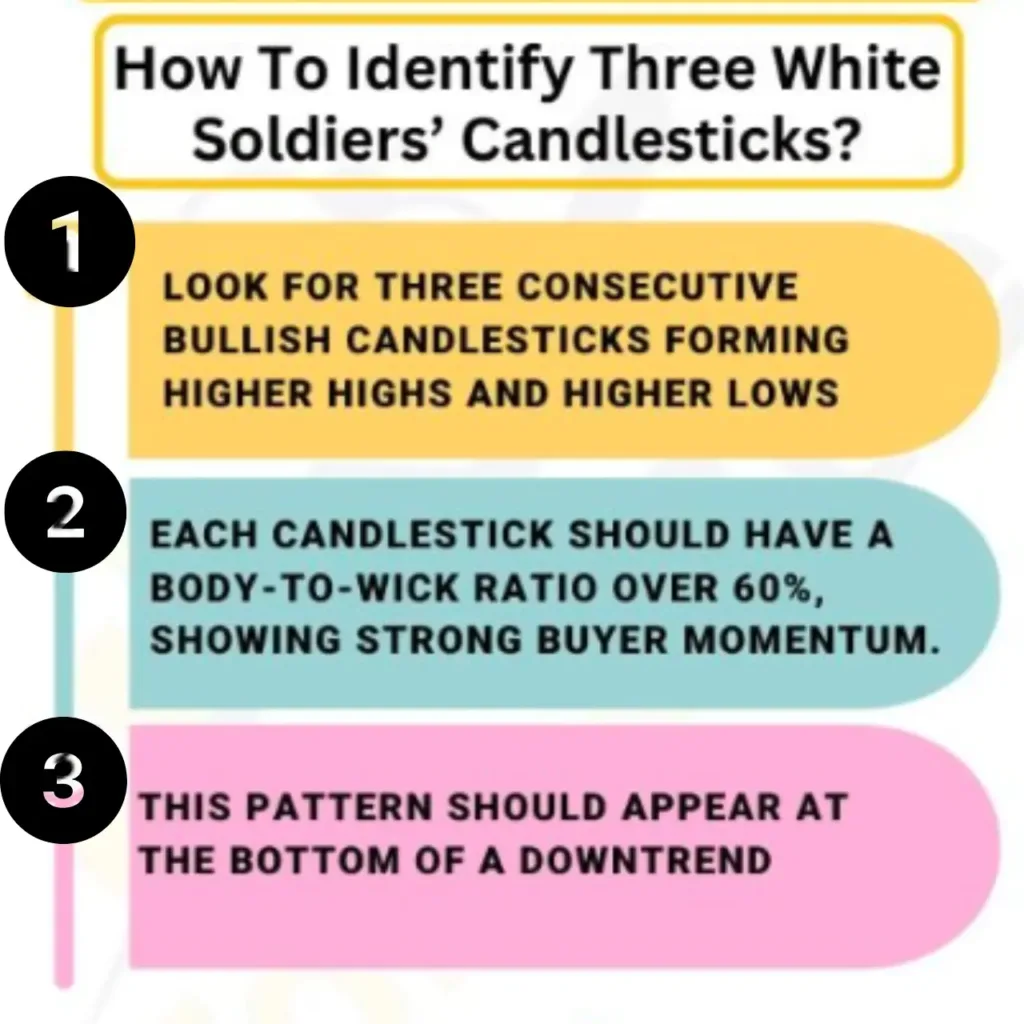

16. Three White Soldiers

Three White Soldiers is a good continuation pattern with three long bullish candles finishing higher. New candles within previous ones at their peaks imply continuous demand and growth. Trade volume over average shows growth. Trades forecast market upswings using the Three White Soldiers pattern. Bitcoin candlestick patterns show market emotion and money movement. These patterns can assist traders navigate markets and win.

The Complete Candlestick Pattern Analysis Guide

Candlestick patterns help traders track market price changes. These patterns assist traders predict price rises and market behavior. This data may help bitcoin traders make better decisions and execute trades more accurately, improving profits.

Danger Reduction Potential

Long-term bitcoin trading needs risk management. Trading losses can be decreased with candlestick patterns and risk management. Safe trading, diversification, and stop-loss orders lower risk. Risk managers assist traders keep money and limit market volatility. This preserves trading tactics.

Resistance to Market Volatility

Bitcoin markets are volatile, so traders may win or lose. Technical indicators, candlestick patterns, and risk management reduce volatility. Agile, disciplined, and talented traders prosper in the volatile digital asset market.

Conclusion

In conclusion, candlestick patterns are crucial for bitcoin traders. Signals interpretation in market dynamics lets traders comprehend price changes and make informed decisions. candlestick analysis helps bitcoin traders profit.