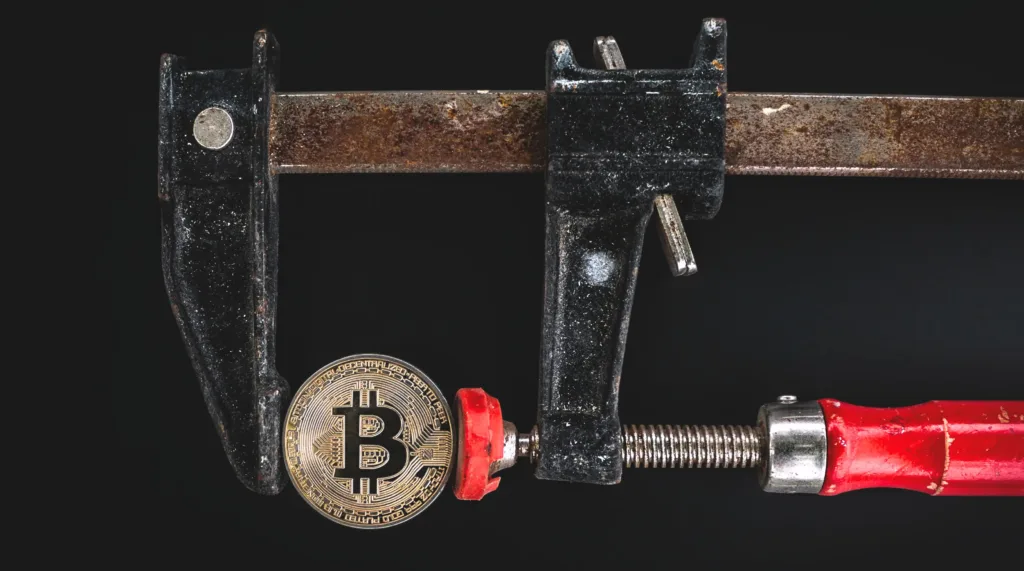

Bitcoin adoption regulatory challenges: combining innovation with stability to promote financial inclusion and reduce digital wealth transfer concerns.

Cryptocurrency Economy

Digital currencies changed the global economy from skepticism to embrace. This dynamic company’s economic effects and trends must be forecasted.

Institutional Bitcoin adoption is strong. Governments and banks assess cryptocurrency. Bitcoin banks and Tesla and Square’s billions legitimize bitcoin. This tendency may continue if laws and institutions clarify.

Institutional Confidence in Cryptocurrencies Soars

Institutions now appreciate cryptocurrencies after being wary. Digital currencies’ popularity and investment success raise awareness. Institutions favor cryptocurrency growth.

The Tesla and Square investments boost Bitcoin’s credibility. Tesla’s $1.5 billion Bitcoin purchase and Square’s ongoing Bitcoin investment demonstrate institutional trust in digital assets. These steps legitimize cryptocurrency and attract new enterprises.

1. Musk’s early 2021 $1.5 billion Bitcoin investment was notable. This and Elon Musk’s social media support for cryptocurrencies shocked the financial world and revived digital asset interest. Tesla bravely stored treasury reserves in Bitcoin.

2. Square: Jack Dorsey’s financial services firm has long backed crypto. Square Cash simplifies Bitcoin trading and holding.

3. Bitcoin investment by Tesla and Square increased institutional trust. Companies promoting Bitcoin legitimize it. This institutional endorsement clears digital assets for institutional usage.

4. Signaling Opportunity: Tesla and Square’s Bitcoin acquisitions have inspired other corporations to utilize crypto. Banks may adopt cryptocurrencies when more companies do. Tesla and Square endorsements boosted institutional Bitcoin investment.

5. Future Impact: Tesla and Square’s bitcoin entry signals digital asset acceptance. Companies investing in crypto will boost demand. Bitcoin legitimization by these firms affects banking and digital money.

Embracing Change: Banks Enter the Bitcoin Arena

Banks accept bitcoin. Traditional institutions previously distrusted cryptocurrency. Growing digital asset buying, selling, and storage infrastructure makes institutions comfortable issuing cryptocurrencies. Bitcoin’s institutional use is limited. Governments and regulators want clear digital asset legislation as institutional investment develops. Legal clarity reduces risk and uncertainty for bitcoin institutional investors. Bitcoin institutionalization improves transaction and investment infrastructure. Trading platforms, institutional custodial solutions, and regulatory-compliant investments are our products. Infrastructure upgrades promote institutional digital asset trust.

Legal Scene

Regulations determine cryptocurrency’s future. Global governments struggle to regulate this new asset class. Governments may distrust crypto regulation. Innovation, consumer protection, and financial stability can be balanced by regulations. Clear, welcoming rules may mainstream cryptocurrencies. Global cryptocurrency laws are complex. Countries regulate cryptocurrencies differently, fragmenting the ecosystem. Bitcoin enterprises profit from Swiss and Singapore regulations. China and India restrict trade.

Governance concerns plague cryptocurrencies. Bitcoin may aid terrorists and money laundering. Regulators face market stability, investor safety, and cryptocurrency’s impact on banks. Policies must balance innovation, economic growth, and these challenges.

Crime Risk Mitigation

Cryptocurrencies’ anonymity and decentralization hamper law enforcement. Bitcoin anonymity aids money laundering, terrorism funding, and crime. To limit bitcoin exploitation and hazards, use AML and KYC. Traditional financial markets are safer than crypto. Exchange failures and security breaches put investors at risk of fraud, market manipulation, and fund loss. Investor and market protection requires bitcoin exchange and service provider transparency, custody, and licencing.

1. Volatility and Risk: Cryptocurrency price fluctuations may bankrupt investors rapidly. Volatility worries new investors. Regulators must advise crypto investors.

2. Preventing Fraud and Market Manipulation: Decentralized and pseudonymous cryptocurrencies are prone to fraud. False advertising, insider trading, and pump-and-dump defraud investors Investors and market integrity demand strict government anti-fraud measures.

3. Security and Custody: Bitcoin wallet and exchange investors face security breaches and failures. High-profile breaches and thefts cost investors billions, necessitating protection and custody. Exchange investors’ capital are protected via storage, insurance, and cybersecurity.

4. Bitcoin investment safety demands openness. Regulators should require cryptocurrency projects and exchanges to disclose funding and risks. Data helps bitcoin investors assess assets.

5. Licensed bitcoin exchanges and service providers eliminate crooks and follow rules. KYC/AML, capital, audit, and exchange licenses are needed. Exchange regulation protects markets and investors.

Mitigating Cryptocurrency Risks: The Call for Regulatory Safeguards

The rapid growth and speculation of cryptocurrency markets undermine financial stability. Financial institution cryptocurrencies may generate price volatility, liquidity issues, and market failures. Regulating bitcoin systemic risks may need margin, position, and circuit breakers.

1. Understanding Systemic Risks: Cryptocurrency markets are turbulent, speculative, and rising fast. These attributes entice high-return investors but threaten financial stability. Financial institutions embracing cryptocurrencies may generate price volatility, liquidity shortages, and market manipulation.

2. Volatility and falls in cryptocurrency prices might generate panic selling and losses. Global financial stability is threatened by bank bitcoin trading.

3. Bitcoin market fragmentation and liquidity constraints generate price volatility and inefficiency. Disorganized exchanges and platforms impair price discovery and liquidity management. Regulators must keep markets liquid to avert disruptions.

4. Regulators can manage Bitcoin systemic risks. Margin, position limitations, and circuit breakers reduce mainstream financial market risk. Investors are protected by leveraged trading margin, position limits to avoid market manipulation, and circuit breakers to stop trading during high volatility.

5. Collaboration and Regulation: Global cryptocurrency market systemic concerns demand coordinated monitoring and regulation. Market monitoring, information exchange, and regulatory harmonization can be enhanced by international regulators and standard-setters. Bitcoin systemic faults may be detected and remedied simultaneously, enhancing financial stability and investor trust.

Balancing Innovation and Stability

Unregulated wealth transfer and storage may disrupt financial institutions using cryptocurrencies. This innovation may increase financial inclusion and efficiency, but financial institutions’ stability and resilience are questioned. Financial regulators must innovate and stabilize.

1. Despite challenges, cryptocurrencies flourish. Cryptocurrency blockchain may transform banking, supply chain, and healthcare. Regulators must balance innovation and risk reduction for consumers, investors, and the economy.

2. Crypto causes governments to modify legislation. Governments questioned cryptocurrency’s financial soundness. As the industry expands and receives public attention, authorities are increasingly amenable to inventive and risk-reducing restrictions.

3. Regulations affect cryptocurrencies. Regulatory uncertainty can induce price volatility as investors react to news and speculation. Clear and supportive rules may enhance bitcoin investment and acceptance by restoring market trust.

4. Future: Governments, companies, and international organizations may control cryptocurrency. Innovation and institutional investment require uniform regulations. To balance innovation, consumer protection, and financial stability, authorities should negotiate.

Financial Decentralization

Decentralization alters money. DeFi systems enable blockchain-based peer-to-peer lending, borrowing, trading, and more without banks. The fast rise of DeFi highlights the need for inclusive, transparent, and accessible financial services. Growing DeFi may challenge traditional finance and the global economy.

1. Ethereum financial apps and services DeFi. Without brokers or banks, smart contracts function. DeFi is utilized in DEXs, lending protocols, yield farming platforms, etc.

2. DeFi provides direct power. Blockchain lowers DeFi peer-to-peer transaction costs and boosts efficiency. Disintermediation frees users financially and removes centralized institutions.

3. DeFi systems allow anyone with an internet connection and digital wallet to use banking services. Access aids unbanked. DeFi supports global economic growth and financial inclusion.

4. DeFi protocol advances with TVL over billions. This increase comes from developers, entrepreneurs, and consumers trying new DeFi apps and protocols. DeFi expands beyond commerce and farming loans.

5. DeFi financial services may challenge traditional finance with their efficiency, transparency, and accessibility. Centralized institutions and the global financial system might be destabilized by DeFi. To succeed, DeFi must overcome regulatory and scalability challenges.

NFTs and Digital Ownership

As an innovative digital asset exchange technique, NFTs are expanding. Digital art, collectibles, real estate, and games symbolize ownership and scarcity using NFTs. Though nascent, NFT has gained investment and cultural interest. Many sectors’ NFT integration may modify digital asset pricing, providing creators and investors new possibilities.

1. Understanding NFTs: Unique digital tokens. Each NFT has its unique value and characteristics, unlike Bitcoin and Ethereum. Differentiation lends NFTs digital credibility.

2. Beyond digital art and collectibles, NFTs are used. NFTs tokenize games, movies, tweets, and virtual property. The NFT industry has grown and attracted global innovators, investors, and collectors due to its adaptability.

3. On NFTs, digital artists, performers, and producers sell their work and interact with fans, generating a cultural phenomenon and business opportunity. Popular purchases have boosted NFT investment and value. From Beeple’s $69 million auction to Top Shot’s millions of basketball video, NFTs are popular online.

4. Redefining Digital Ownership: NFTs may impact digital asset pricing. Due of digital ownership and scarcity, NFTs assist artists manage IP. NFTs allow investors variety, profit, and direct support for their favorite artists and enterprises.

5. Opportunities: NFTs will extend into other industries, offering creators, investors, and consumers new choices. NFT applications like fractional ownership of real-world assets and gaming and entertainment revolution are exciting. How NFTs affect digital ownership and innovation will be exciting.

Scalability, Interoperability

Blockchain lacks interoperability and scalability. High transaction latency and costs must be addressed to boost bitcoin adoption. Blockchain interoperability scaling and layer 2 protocols fix this. Scaling and interoperating blockchain networks can boost bitcoin acceptance and utility.

1. Block chain transaction capacity. In high demand, Bitcoin and Ethereum’s scalability concerns generate congestion and excessive fees. To solve scalability difficulties, developers are contemplating higher block sizes, sharding, and layer 2 scaling approaches like the Lightning Network and sidechains.

2. Off-chain and on-chain layer 2 scaling solutions scale blockchain networks. Transactions are faster and cheaper with less primary blockchain burden. Layer 2 rollups and state channels develop Bitcoin Lightning and Ethereum 2.0. 3. Interoperability simplifies blockchains. Autonomous blockchains limit value and data. Cross-chain asset transfer and communication protocols and bridges are being developed.

Blockchain Interoperability Solutions

Share data and assets. Polkadot, Cosmos, and Interledger may help chains communicate. These protocols streamline asset and data transmission between blockchain networks, extending use cases and strengthening blockchain technology. Cryptocurrency acceptance and utility need blockchain network scalability and interoperability. Scaling issues can make cryptocurrencies more useful and efficient for daily usage, enticing conventional users and companies. Interoperable blockchains stimulate decentralized app and use case innovation. Bitcoin will age well. Scalability, interoperability, institutional adoption, DeFi, NFTs, and regulations change the digital economy. Despite legal and technological hurdles, cryptocurrencies might change digital asset trading, investment, and the economy.